Understanding Mortgage Foreclosure in Canada

Understanding Mortgage Foreclosure in Canada Sometimes, life can be full of surprises, as we learned from COVID-19. Even with careful planning, we can encounter unexpected occurrences. When you purchase a home, you might have more significant plans for it. You imagine the different projects you’ll do and the memories you’ll make there. But you probably […]

The Top 10 Mortgage Mistakes Often Made By Canadians

The Top 10 Mortgage Mistakes Often Made By Canadians In several years of working with mortgages, I’ve noticed many people in Canada make common mortgage mistakes when getting a mortgage. People tend to focus too much on small details that don’t matter much while overlooking critical terms in their contracts. This article is here to […]

Pros And Cons of Buying a House With Cash

Pros And Cons of Buying a House With Cash By now, you’ve probably heard countless times that it isn’t a good idea to be in debt and that paying for things with cash upfront rather than relying on credit is better. But have you ever thought about buying your next house outright with cash, or […]

What Are the Requirements and Qualifications Of Mortgage for Self-Employed in Canada?

Self-Employed Mortgage in Canada: What Are the Requirements and Qualifications? A report from Statistics Canada indicated that over 2.6 million Canadians are self-employed. This implies that around 15% of workers in Canada are their own bosses. Being self-employed has its pros, but one challenge self-employed people might encounter is qualifying for a mortgage. Purchasing a […]

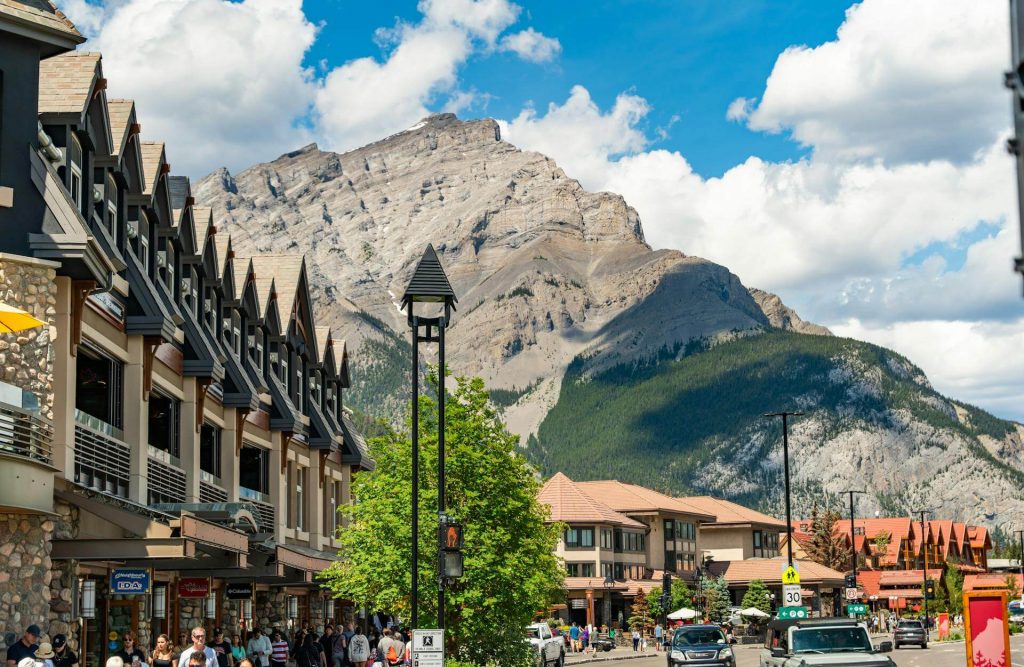

What Are the Types of Houses in Canada

What Are the Types of Houses in Canada There is a variety of houses you can purchase in Canada, including condominiums, townhouses, and detached and semi-detached homes. If you plan to rent or buy a house in Canada, you must decide which house fits you or your budget. Since each type of house has unique […]

How To Secure A Mortgage After Landing A New Job

How To Secure A Mortgage After Landing A New Job When planning to purchase your first home, lenders focus on one crucial factor: your future income stability. Landing a new job comes with lots of excitement, but it can also ignite worries about qualifying for a mortgage with a relatively fresh and possibly uncertain source […]

Consolidate Debt Through Mortgage Refinancing in Canada

How To Consolidate Debt Through Mortgage Refinancing in Canada Many Canadians face the burden of credit card debt. If your debt is taking a toll on your financial and mental health, it might be wise to consolidate debt into a single loan. This approach lets you settle your balances entirely and manage your debt with […]

Closed Vs. Open Mortgages: What’s The Difference?

Closed Vs. Open Mortgages: What’s The Difference? When deciding between a closed and open mortgage, the primary consideration is whether you want lower interest rates or flexibility. Whether you’re looking to renew your existing mortgage or a new one, you must decide whether to go for a closed or open mortgage. Although closed mortgages sometimes […]

How to Get a Second Mortgage in Canada

How to Get a Second Mortgage in Canada? A second mortgage in Canada is an additional loan secured against a property that already has an existing mortgage. While it can help access cash from your home’s equity, it also means managing two loan repayments at once — and there’s a risk of losing your house […]

How to Properly Compare Mortgage Interest Rates in Canada

How to Properly Compare Mortgage Interest Rates in Canada The interest rate is crucial when buying a home or refinancing your mortgage in Canada. But with so many options, how do you compare mortgage interest rates in Canada effectively? At Superb Mortgages, we recognize the significance of securing the best mortgage interest rate for your […]